Figure 1 East Africa Regional Grain Trade for the Week Ending 1 September 2017

The Week’s Market Analysis

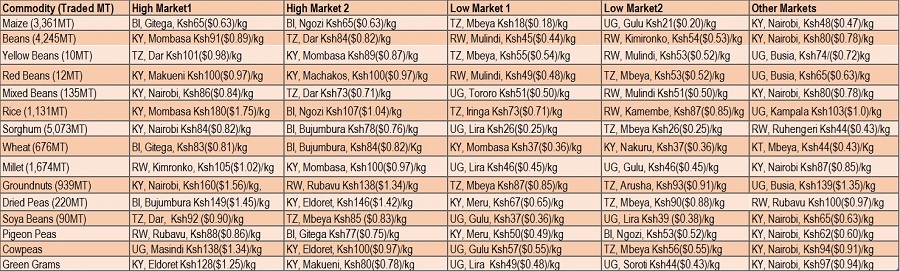

- Sorghum (5,073MT) was the most traded commodity during the week ending 1st September 2017. Beans (4,245MT), Maize (3,361MT), Millet (1,674MT), and Groundnuts (939MT) were the other leading commodities for the week. Trade volumes for the other commodities are indicated on Table 1 “The Week’s Market Prices for Select Markets”.

- There was very little trade between Kenya and Tanzania (148MT), in comparison to Tanzania – Uganda (2,539MT), and Tanzania – Rwanda (665MT). Most of the commodities traded in the East Africa region end up in Kenya, it is therefore safe to conclude various reports of Tanzania imposing trade barriers on Kenya as probably true, based on the flow of commodities moving from Tanzania to Uganda then Kenya. This is something the region’s trade policy experts need to look at.

- Malawian groundnuts are in plenty of supply in Uganda and Rwanda, as both countries seems to have increased their imports of groundnuts from Tanzania. Uganda exports groundnuts to Rwanda, Rwanda exports groundnuts to DRC.

- Trade between Rwanda and DRC significantly declined during the week. Rwanda did not export any maize and rice to DRC has in the previous weeks, there was also a significant reduction in the amount of wheat exported to DRC.

The Week’s Market Prices for Select Markets

The price of maize in Nairobi, is expected to go up, as the Government of Kenya maize flour subsidy program is coming to an end. Unfortunately for Kenyans, this comes at a time when the price of maize in Uganda, is beginning to increase, as the season wides up. However this should be good news for Zambia and Malawi maize suppliers who have been wanted to export more maize to Kenya.

The Week’s Market Opportunities

Betta Grains continues to receive various request to buy and sell grains and cereal. Kindly visit our eDuka page https://www.bettagrains.com/?page_id=1236 for a more up to date list.

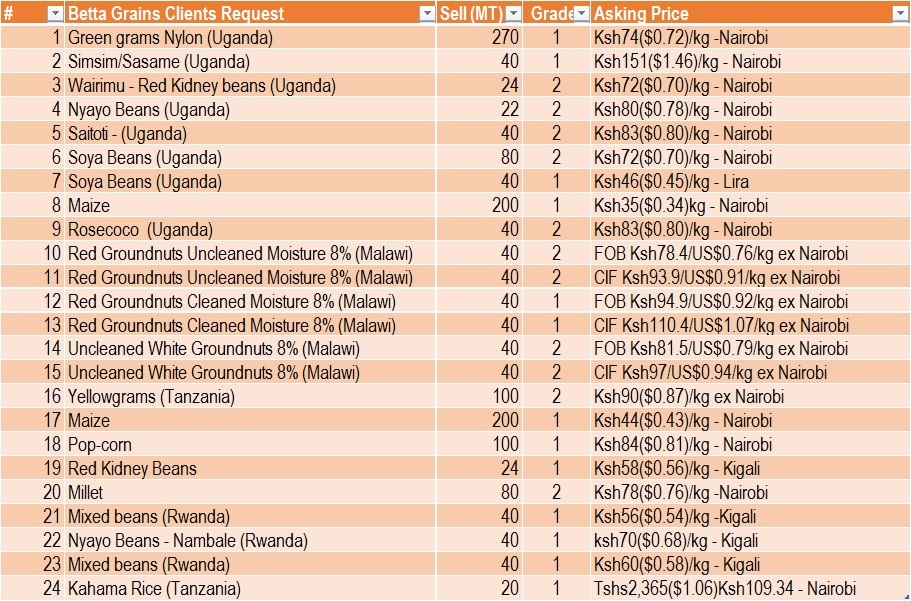

Table 2: Market Opportunities for the Week ending 1 September 2017

Table 2: Market Opportunities for the Week ending 1 September 2017

Author; Fostina Mani, Betta Grains. Fostina.Mani@bettagrains.com, Twitter: @FostinaMani.

Acknowledgment: The data used for the analysis has been obtained from; IAM, Government of Kenya, Ministry of Agriculture, Livestock & Fisheries, Government of Tanzania, Ministry of Trade and Industry, EAGC, RATIN, Farm Gain Uganda, FEWS NET, & Betta Grains.

Disclaimer. Due to unavailable of data on various border points on formal cross-border trade flows and volumes in the public arena. The volumes indicated above are mostly from the informal cross-border data that is available to the public. The purpose of the analysis, is simply to provide an indication of the East Africa Regional Trade flow to SMEs, Smallholder Farmers, and Other Stakeholders in a manner and language that is applicable, simple, and makes sense. Those desiring to obtain actual trade volumes are advised to contact various internationally funded government projects that have been mandated to provide the regional trade data for public good.

©Betta Grains 2017

Table 1 – Market Prices for Select Markets in the East Africa Region for the Week Ending 1 September 2017

Table 1 – Market Prices for Select Markets in the East Africa Region for the Week Ending 1 September 2017