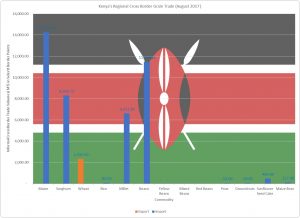

August 2017 started with a lot of uncertainty due to fears of post-election violence in Kenya. The announcement of the presidential results directly affected the East Africa cross border trade. With Kenya going back to the ballot box after the nullification of the presidential election by Kenya’s Supreme Court, regional trade will be affected. Kenya was the month’s leading net importer (41,432MT) of grains, a huge reduction from July 2017 (67,879MT). Kenya’s export in August 2017 were (2,331MT), slightly down from July 2017 (2,629MT). Wheat was Kenya’s only grain export in the region. Kenya’s leading grain imports were maize, beans, sorghum and millet.

August 2017 started with a lot of uncertainty due to fears of post-election violence in Kenya. The announcement of the presidential results directly affected the East Africa cross border trade. With Kenya going back to the ballot box after the nullification of the presidential election by Kenya’s Supreme Court, regional trade will be affected. Kenya was the month’s leading net importer (41,432MT) of grains, a huge reduction from July 2017 (67,879MT). Kenya’s export in August 2017 were (2,331MT), slightly down from July 2017 (2,629MT). Wheat was Kenya’s only grain export in the region. Kenya’s leading grain imports were maize, beans, sorghum and millet.

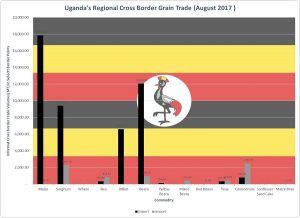

In August 2017, Uganda was the leading net exporter (47,574MT) of grains a huge decrease from July 2017 (62,208MT). The country imported (9,201MT) an increase from July 2017 (8,593MT). Uganda’s leading exports were maize, beans, sorghum and millet mostly exports to Kenya. Uganda fed Kenya in August 2017.

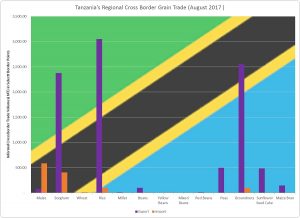

Tanzania was the 2nd net exporter of grains in August 2017 (11,774MT), down from July 2017 (11,805MT). The country imported (1,212MT), up from July 2017 (1,127MT). The country’s leading exports were sorghum, rice and groundnuts.

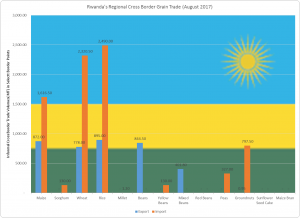

In August 2017, Rwanda was a net importer of grains having exported (3,792MT) down from July 2017 (9,716MT) and imported (8,879MT) up from July 2017 (5,702MT). Rwanda exported more grains than Kenya in August 2017. Rwanda’s leading imports were rice, wheat, and maize, while the country’s leading exports were beans, rice, and maize mostly exports to DRC.

In August 2017, Rwanda was a net importer of grains having exported (3,792MT) down from July 2017 (9,716MT) and imported (8,879MT) up from July 2017 (5,702MT). Rwanda exported more grains than Kenya in August 2017. Rwanda’s leading imports were rice, wheat, and maize, while the country’s leading exports were beans, rice, and maize mostly exports to DRC.

Commodity Prices for the last Week of August 2017

So! What is the September 2017 Outlook for Kenya?

Kenya is currently harvesting maize, however the low harvest production compounded with the conclusion of the government’s maize subsidy program, Kenyans can expect the price of maize to increase slightly. The Government has expressed commitment to not importing any more maize into the country, citing fears of a maize glut, which would lead to serious losses for Kenyan farmers. However, Maize is a highly political crop, with the country going into election, it is very difficult to predict the maize outlook in the month of September 2017. If it not campaign give-away, it will be price interference by the government either way maize traders remain very apprehensive on Kenya’s maize market.

According to Farm Gain, maize prices in Busia, Uganda started increasing at the end of August 2017 as Kampala started offering a much higher price than Busia, causing more maize trade to move away from Busia to Kampala. FEWSNET reports the majority of the countries in the East Africa are making preparations to plant for the upcoming rains, with reports of above average rainfall for Kenya and South Sudan. Ethiopia and Uganda have experienced flooding in some areas, Somalia remains dry and sunny. The Government of Malawi is also reported to have issued a ban on maize export, however the informal export of maize to Tanzania and Mozambique seems to have increased, while the informal importation of maize into Malawi decreased. September 2017 will certainly be a very interesting month to watch with regard to Africa’s grain trade.

Exchange Rate used US$1=Ksh102.75/-

Written by Fostina Mani, Betta Grains. Fostina.Mani@bettagrains.com, Twitter: @FostinaMani, www.bettagrains.com

Acknowledgment: The data used for the analysis has been obtained from; IAM, Government of Kenya, Ministry of Agriculture, Livestock & Fisheries, Government of Tanzania, Ministry of Trade and Industry, EAGC, RATIN, Farm Gain Uganda, FEWS NET, & Betta Grains.

Disclaimer. Due to unavailable of data on various border points on formal cross-border trade flows and volumes in the public arena. The volumes indicated above are mostly from the informal cross-border data that is available to the public. The purpose of the analysis, is simply to provide an indication of the East Africa Regional Trade flow to SMEs, Smallholder Farmers, and Other Stakeholders in a manner and language that is applicable, simple, and makes sense. Those desiring to obtain actual trade volumes are advised to contact various internationally funded projects and government ministries that have been mandated to provide the regional trade data for public good.