July 2017, was the peak of political campaigns, and the government of Kenya made sure that GoK90 continued to be easily available. By end of July 2017, Kenyan consumers had stopped worrying about maize meal, as the commodity was readily available. The government of Kenya was a leading buyer of maize from Uganda, and Zambia, with unconfirmed reports of Ethiopia as well. In July 2017, Kenya was the Leading Net Importer (67,879MT), a 2% increase in comparison to June 2017 net import (66,312MT). Kenya imported (70,508MT) and exported (2,629MT). Wheat continues to be Kenya’s leading export in the region.

July 2017, was the peak of political campaigns, and the government of Kenya made sure that GoK90 continued to be easily available. By end of July 2017, Kenyan consumers had stopped worrying about maize meal, as the commodity was readily available. The government of Kenya was a leading buyer of maize from Uganda, and Zambia, with unconfirmed reports of Ethiopia as well. In July 2017, Kenya was the Leading Net Importer (67,879MT), a 2% increase in comparison to June 2017 net import (66,312MT). Kenya imported (70,508MT) and exported (2,629MT). Wheat continues to be Kenya’s leading export in the region.

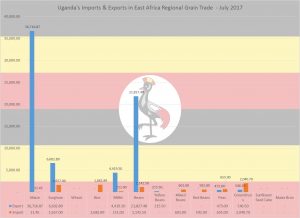

Uganda was the Leading Net Exporter (62,208MT) in July 2017, a 3% decrease in comparison to June 2017. Uganda exported (70,801MT) and imported (8,593MT). Uganda’s exports were maize, sorghum, millet, and beans. Maize was Uganda’s leading export in July 2017, however towards the end of the month the price of maize started dropping towards the Ksh23 ($0.22)/kg. Clearly, Uganda fed Kenya.

Tanzania was the 2nd Net Exporter (11,805MT) in July 2017, an 11% decrease from June 2017 (13,289MT). Tanzania exported (12,932MT) and imported (1,127MT). Tanzania’s leading exports were rice , groundnuts, sunflower seed cake and seed meal. The recorded data indicated that Tanzania exported maize (1,231MT) to Kenya, the maize may actually have been Kenyan imports from the Southern Africa countries namely Zambia.

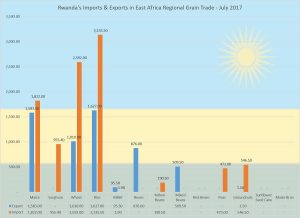

While Rwanda was a Net Importer (4,014MT) in July 2017, the country’s net import decreased by 23% from (5,235MT) in June 2017. Rwanda imported (5,702MT), and exported (9,716MT). The leading exports were maize, wheat, and rice. However, some of the commodities may have been exports to DRC from Kenya, Uganda, and Tanzania. Rwanda’s leading imports were maize, wheat, sorghum, and rice.

While Rwanda was a Net Importer (4,014MT) in July 2017, the country’s net import decreased by 23% from (5,235MT) in June 2017. Rwanda imported (5,702MT), and exported (9,716MT). The leading exports were maize, wheat, and rice. However, some of the commodities may have been exports to DRC from Kenya, Uganda, and Tanzania. Rwanda’s leading imports were maize, wheat, sorghum, and rice.

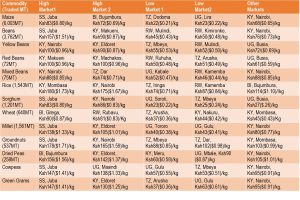

Commodity Prices for the last Week of July 2017

So! What is the August 2017 Outlook for Kenya? The price of maize will drastically reduce because Kenya is harvesting maize, and green grams. Zambia and Uganda continue to compete for the Kenyan market, which will also help reduce the price of maize, and hopefully that of maize meal. If the Kenyan government continues to subsidize the price of maize meal, Kenyans may enjoy some slight comfort, unlike the experiences of May and June 2017. The price of beans and green grams is also expected to drop further, as the country continues to harvest. A word of caution is, the country had below average harvest, this means that the price of maize, green grams and beans may increase especially during the months of October and November 2017. If the Kenyan farmers can fumigate and proper store green grams, there are indication of profits towards the end of the year.

Exchange Rate used US$1=Ksh103.75/-

Written by Fostina Mani, Betta Grains. Fostina.Mani@bettagrains.com, Twitter: @FostinaMani,

Acknowledgment: The data used for the analysis has been obtained from; IAM, Government of Kenya, Ministry of Agriculture, Livestock & Fisheries, Government of Tanzania, Ministry of Trade and Industry, EAGC, RATIN, Farm Gain Uganda, FEWS NET, & Betta Grains.

Disclaimer. Due to unavailable of data on various border points on formal cross-border trade flows and volumes in the public arena. The volumes indicated above are mostly from the informal cross-border data that is available to the public. The purpose of the analysis, is simply to provide an indication of the East Africa Regional Trade flow to SMEs, Smallholder Farmers, and Other Stakeholders in a manner and language that is applicable, simple, and makes sense. Those desiring to obtain actual trade volumes are advised to contact various internationally funded projects and government ministries that have been mandated to provide the regional trade data for public good.