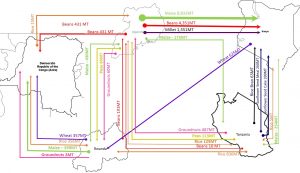

Maize (9,489MT) was the highest traded commodity in the region in the  week ending 21st July 2017, a decrease from the previous week (11,304MT). The price of maize is on a decline across all Kenyan markets, as many parts of the country have started harvesting fresh maize. The Government of Kenya’s promise to import more maize at a much lower price seems to have finally pushed the price of maize on a downward trend. Zambians and Malawi traders continue looking at exporting maize to Kenya, which seems to offer a much more favourable price, despite unconfirmed reports of Tanzania’s continual barriers towards Kenyan imports from Southern Africa region. Maize wholesale prices were highest in South Sudan, Juba Ksh83($0.80)/kg, and Burundi Gitega, Ksh72($0.69)/kg. The lowest prices were in Tanzania, Mbeya Ksh21($0.20)/kg and Uganda, Kampala Ksh24($23)/kg. Kenya reported the following wholesale prices Kisumu, Ksh60($0.58)/kg, Nairobi, Ksh48($0.46)/kg, and Eldoret Ksh39($0.38)/kg. Busia market reported a wholesale price of Ksh27($0.26)/kg.

week ending 21st July 2017, a decrease from the previous week (11,304MT). The price of maize is on a decline across all Kenyan markets, as many parts of the country have started harvesting fresh maize. The Government of Kenya’s promise to import more maize at a much lower price seems to have finally pushed the price of maize on a downward trend. Zambians and Malawi traders continue looking at exporting maize to Kenya, which seems to offer a much more favourable price, despite unconfirmed reports of Tanzania’s continual barriers towards Kenyan imports from Southern Africa region. Maize wholesale prices were highest in South Sudan, Juba Ksh83($0.80)/kg, and Burundi Gitega, Ksh72($0.69)/kg. The lowest prices were in Tanzania, Mbeya Ksh21($0.20)/kg and Uganda, Kampala Ksh24($23)/kg. Kenya reported the following wholesale prices Kisumu, Ksh60($0.58)/kg, Nairobi, Ksh48($0.46)/kg, and Eldoret Ksh39($0.38)/kg. Busia market reported a wholesale price of Ksh27($0.26)/kg.

Beans (4,943MT) was the 2nd highest traded commodity in the week, a huge decrease from the previous week (6,733MT). Beans wholesale price were highest in South Sudan, Juba Ksh157($1.51)/kg, and Kenya, Mombasa Ksh89($0.86)/kg. The prices were lowest in Rwanda, Mulindi, Ksh47($0.45)/kg. Yellow Beans (85MT) was traded, up from the previous week (50MT). The trade was Uganda exports to Rwanda (70MT), and to Tanzania (15MT). Yellow beans wholesale prices were highest in Kenya, Machakos and Makueni at Ksh110($1.06)/kg, and Nairobi Ksh100($0.96)/kg. The prices were lowest in Tanzania, Mbeya Ksh56($0.54)/kg. Red Beans (106MT) were traded during the week, a decrease from (200MT) the previous week. The trade was Tanzania exports to Uganda (106MT). Red beans wholesale prices were highest in Kenya, Machakos and Makueni Ksh100($0.96)/kg. The prices were lowest in Rwanda, Mulindi Ksh48($0.46)/kg. Rwanda exported Mixed Beans (146MT) to Uganda. Mixed beans wholesale prices were highest in Kenya, Nairobi, Ksh88($0.85)/kg, and Tanzania, Dar Ksh74($0.71)/kg. The prices were lowest in Uganda, Kabale Ksh49($0.47)/kg and Rwanda, Kamemba Ksh46($0.44)/kg. Uganda, Busia sold mixed beans at Ksh51($0.49)/kg. The price of beans in Nairobi is on a decline, despite Kenya having produced below average yields.

Rice (1,342MT) was traded, a decrease from the previous week’s (1,835MT). Rice prices are increasing in all markets. Wholesale prices were highest in Kenya, Mombasa Ksh180($1.73)/kg, Nairobi Ksh175($1.67)/kg, and Eldoret Ksh152($1.46)/kg. The Nairobi market is currently experiencing a shortage of the long grain “Biriyani/Sindano” Pakistan imported rice, which consumers have been forced to substitute with Thai rice. Rice prices were lowest in Tanzania, Iringa Ksh74($0.71)/kg. Sorghum (3,537MT) was traded, a 201% increase from the previous week (1,757MT). Sorghum wholesale prices were highest in South Sudan, Juba Ksh83($0.80)/kg, Kenya, Nairobi Ksh84($0.81)/kg, and lowest in Uganda, Tororo Ksh26($0.25)/kg and Tanzania, Mbeya Ksh25($0.24)/kg. Wheat (982MT) was traded, prices were highest in Burundi, and Bujumbura Ksh90($0.87)/kg, and lowest in Tanzania, Arusha, Ksh37($0.36)/kg.

Millet (1,561MT) was traded, another huge increase from the previous week (989MT). There is a huge shortage of millet in the Nairobi market, which explains the increased volumes of millet imports into the country. Millet wholesale price have increased sharply, with the highest wholesale prices in South Sudan, Juba Ksh137($1.32)/kg, Kenya, Eldoret Ksh105($1.01)/kg and lowest in Uganda, Tororo Ksh43($0.41)/kg. Nairobi reported a wholesale price is Ksh81($0.78)/kg. Groundnuts/Peanuts (541MT) was traded in the week. The wholesale prices of groundnuts were highest in South Sudan, Juba Ksh176($1.69)/kg, Kenya, Nairobi Ksh145($1.40)/kg, and Eldoret Ksh146($1.41)/kg. The wholesale prices were lowest in Tanzania, Mbeya Ksh89($0.86)/kg. Dried Green Peas/Mijii/Pisum Sativum (198MT) was traded prices were highest in Burundi, Bujumbura Ksh162($1.56)/kg, and lowest in Kenya, Meru, Ksh60($0.58)/kg.

There was no reported cross border trade on Cowpeas, however the Nairobi market has started receiving this season harvest, at record high wholesale prices of Ksh88/kg($0.85), more than double last season retail price. Prices were highest in South Sudan, Juba Ksh148($1.43)/kg, Uganda, Masindi Ksh155($1.49)/kg, and Kenya, Eldoret Ksh105($1.01)/kg. The prices were lowest in Uganda, Gulu Ksh52($0.50)/kg, and Tanzania, Mbeya Ksh53($0.51)/kg. Green grams continue to be harvested in various parts of Kenya, the Nairobi market is currently enjoying high quality green grams. India is reported to having a bumper harvest of green grams, reflected in the lower market prices in comparison to the Kenyan market prices. Green grams wholesale prices were highest in South Sudan, Juba Ksh148($1.43)/kg, Kenya, Eldoret Ksh128($1.23)/kg, and Nakuru Ksh100($0.96)/kg. The lowest reported wholesale prices were in Tanzania, Arusha Ksh37($0.36)/kg, Uganda, Gulu Ksh43($0.41)/kg, and Lira Ksh46($0.44)/kg. The Kenya wholesale prices were Makueni Ksh100($0.96)/kg, Mombasa Ksh80($0.77)/kg, and Nairobi Ksh110($1.05)/kg.

Exchange Rate used US$1=Ksh103.85/-

Author; Fostina Mani, Betta Grains. Fostina.Mani@bettagrains.com, Twitter: @FostinaMani.

Acknowledgment: The data used for the analysis has been obtained from; IAM, Government of Kenya, Ministry of Agriculture, Livestock & Fisheries, Government of Tanzania, Ministry of Trade and Industry, EAGC, RATIN, Farm Gain Uganda, FEWS NET, & Betta Grains.

Disclaimer. Due to unavailable of data on various border points on formal cross-border trade flows and volumes in the public arena. The volumes indicated above are mostly from the informal cross-border data that is available to the public. The purpose of the analysis, is simply to provide an indication of the East Africa Regional Trade flow to SMEs, Smallholder Farmers, and Other Stakeholders in a manner and language that is applicable, simple, and makes sense. Those desiring to obtain actual trade volumes are advised to contact various internationally funded government projects that have been mandated to provide the regional trade data for public good.